from Monthly Revirew

by John Bellamy Foster and Robert W. McChesney

The United States and the world are now a good two decades into the Internet revolution, or what was once called the information age. The past generation has seen a blizzard of mind-boggling developments in communication, ranging from the World Wide Web and broadband, to ubiquitous cell phones that are quickly becoming high-powered wireless computers in their own right. Firms such as Google, Amazon, Craigslist, and Facebook have become iconic. Immersion in the digital world is now or soon to be a requirement for successful participation in society. The subject for debate is no longer whether the Internet can be regarded as a technological development in the same class as television or the telephone. Increasingly, the debate is turning to whether this is a communication revolution closer to the advent of the printing press.1

The full impact of the Internet revolution will only become apparent in the future, as more technological change is on the horizon that can barely be imagined and hardly anticipated.2 But enough time has transpired, and institutions and practices have been developed, that an assessment of the digital era is possible, as well as a sense of its likely trajectory into the future.

Our analysis in this article will focus on the United States—not only because it is the society that we know best, and the Internet’s point of origin, but also because it is there, we believe, that one most clearly finds the integration of monopoly-finance capital and the Internet, representing the dominant tendency of the global capitalist system. This is not meant to suggest that the current U.S. dominance of the Internet is not open to change, or that other countries may not choose to take other paths—but only that all alternatives in this realm will have to struggle against the trajectory now being set by U.S. capitalism, with its immense global influence and power.

What is striking, as one returns to the late 1980s and early 1990s and reads about the Internet and its future, is that these accounts were almost uniformly optimistic. With all information available to everyone at the speed of light and impervious to censorship, all existing institutions were going to be changed for the better. There was going to be a worldwide two-way flow, or multi-flow, a democratization of communication unthinkable before then. Corporations could no longer bamboozle consumers and crush upstart competitors; governments could no longer operate in secrecy with a kept-press spouting propaganda; students from the poorest and most remote areas would have access to educational resources once restricted to the elite. In short, people would have unprecedented tools and power. For the first time in human history, there would not only be information equality and uninhibited instant communication access between all people everywhere, but there would also be access to a treasure trove of uncensored knowledge that only years earlier would have been unthinkable, even for the world’s most powerful ruler or richest billionaire. Inequality and exploitation were soon to be dealt their mightiest blow.

The Internet, or more broadly, the digital revolution is truly changing the world at multiple levels. But it has also failed to deliver on much of the promise that was once seen as implicit in its technology. If the Internet was expected to provide more competitive markets and accountable businesses, open government, an end to corruption, and decreasing inequality—or, to put it baldly, increased human happiness—it has been a disappointment. To put it another way, if the Internet actually improved the world over the past twenty years as much as its champions once predicted, we dread to think where the world would be if it had never existed.

We do not argue that the initial sense of the Internet’s promise was pure fantasy, although some of it can be attributed to the utopian enthusiasm that major new technologies can engender when they first emerge. (One is reminded of the early-twentieth-century view of the Nobel Prize-winning chemist and philosopher of energetics, Wilhelm Ostwald, who contended that the advent of the “flying machine” was a key part of a universal process that could erase international boundaries associated with nations, languages, and money, “bringing about the brotherhood of man.”3) Instead, we argue that there was—and remains—extraordinary democratic and revolutionary promise in this communication revolution. But technologies do not ride roughshod over history, regardless of their immense powers. They are developed in a social, political, and economic context. And this has strongly conditioned the course and shape of the communication revolution.

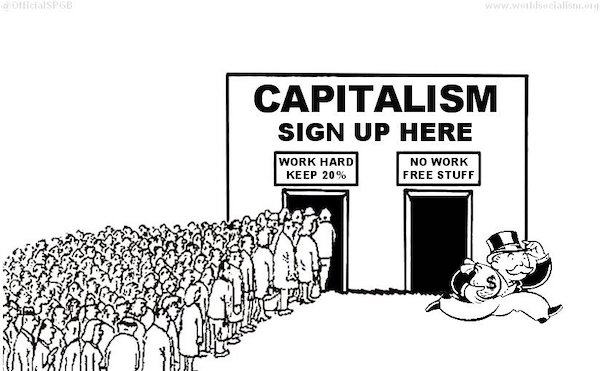

This economic context points to the paradox of the Internet as it has developed in a capitalist society. The Internet has been subjected, to a significant extent, to the capital accumulation process, which has a clear logic of its own, inimical to much of the democratic potential of digital communication, and that will be ever more so, going forward. What seemed to be an increasingly open public sphere, removed from the world of commodity exchange, seems to be morphing into a private sphere of increasingly closed, proprietary, even monopolistic markets.

Our argument is not a socialist argument against capitalism’s anti-democratic tendencies per se, which we then extend to the case of the Internet. Although we would not be uncomfortable taking such a position, it would make something as extraordinary and unique as the digital revolution too much a dependent variable—and it would allow those opposed to socialism to dismiss the argument categorically. Instead, we base our argument on elements of conventional economic thought, produced by scholars who, by and large, favor capitalism as a system. Our critique, derived from classical and mainstream terms of analysis, will repeatedly demonstrate the weaknesses of allowing the profit motive to dictate the development of the Internet.

In particular, we argue that applying the “Lauderdale Paradox” (or the contradiction between public wealth and private riches) of classical political economy makes a strong case that the most prudent course for any society is to start from the assumption that the Internet should be fundamentally outside the domain of capital. We hope to provide a necessary alternative way to imagine how best to develop the Internet in contrast to the commodified, privatized world of capital accumulation. This does not mean that there can be no commerce, even extensive commerce, in the digital realm, but merely that the system’s overriding logic—and the starting point for all policy discussions—must be as an institution operated on public interest values, at bare minimum as a public utility.

It is true that in any capitalist society there is going to be strong, even at times overwhelming, pressure to open up areas that can be profitably exploited by capital, regardless of the social costs, or “negative externalities,” as economists put it. After all, capitalists—by definition, given their economic power—exercise inordinate political power. But it is not a given that all areas will be subjected to the market. Indeed, many areas in nature and human existence cannot be so subjected without destroying the fabric of life itself—and large portions of capitalist societies have historically been and remain largely outside of the capital accumulation process. One could think of community, family, religion, education, romance, elections, research, and national defense as partial examples, although capital is pressing to colonize those where it can. Many important political debates in a capitalist society are concerned with determining the areas where the pursuit of profit will be allowed to rule, and where it will not. At their most rational, and most humane, capitalist societies tend to preserve large noncommercial sectors, including areas such as health care and old-age pensions, that might be highly profitable if turned over to commercial interests. At the very least, the more democratic a capitalist society is, the more likely it is for there to be credible public debates on these matters.

However—and this is a point dripping in irony—such a fundamental debate never took place in relation to the Internet. The entire realm of digital communication was developed through government-subsidized-and-directed research and during the postwar decades, primarily through the military and leading research universities. Had the matter been left to the private sector, to the “free market,” the Internet never would have come into existence. The total amount of the federal subsidy of the Internet is impossible to determine with precision.

As Sascha Meinrath, a leading policy expert, puts it: calculating the amount of the historical federal subsidy of the Internet “depends on how one parses government spending—it’s fairly modest in terms of direct cash outlays. But once one takes into account rights of way access that were donated and the whole research agenda (through the Defense Advanced Research Projects Agency, the National Science Foundation, etc.), it’s pretty substantial. And if you include the costs of the wireless subsidies, tax breaks (e.g., no sales taxes on online purchases), etc., it’s well into the hundreds of billions range.”4 For context, Meinrath’s estimate puts the federal investment in the Internet at least ten times greater than the cost of the Manhattan Project, allowing for inflation.5

That is not all. The early Internet was not only noncommercial, it was also anti-commercial. Prior to the early 1990s, the National Science Foundation Network, the forerunner to the Internet, explicitly limited the network to noncommercial uses. If anyone dared to sell something online, that person would likely be “flamed,” meaning that other outraged Internet users would clog the individual’s email inbox with contemptuous messages demanding that the sales pitch be removed. This internal policing by Internet users was based on the assumption that commercialism and an honest, democratic public sphere did not mix. Corporate media were the problem, and the Internet was the solution. Good Internet citizens needed to be on the level; they should not hustle for profit by any means necessary.

The lack of debate about how the Internet should be developed was due, to a certain extent, to the digital revolution exploding at precisely the moment that neoliberalism was in ascendance, its flowery rhetoric concerning “free markets” most redolent. The core spirit was that businesses should always be permitted to develop any area where profits could be found, and that this was the most efficient use of resources for an economy. Anything interfering with capitalist exploitation was bad economics and ideologically loaded, and was usually advanced by a deadbeat “special interest” group that could not cut the mustard in the world of free market competition and so sought protection from the corrupt netherworld of government regulation and bureaucracy.6 This credo led the drive for “deregulation” across the economy, and for the privatization of once public sector activities.

The rhetoric of free markets was adopted by all sides in the communications debate in the early 1990s, as the World Wide Web turned the Internet seemingly overnight into a mass medium. For the business community and politicians, the Internet was all about unleashing entrepreneurs, slaying monopolies, promoting innovation, and generating “friction-free capitalism,” as Bill Gates famously put it.7 There was great money to be made. Even those skeptical toward corporations and commercialism tended to be unconcerned, if not sanguine, about the capitalist invasion, as the power of this apparently magical technology could override the efforts of dinosaur corporations to tame it. There was plenty of room for everybody. The Internet bubble of the late 1990s certainly encouraged capitalism’s embrace of the Internet, and U.S. news media could barely contain themselves with their enthusiasm for the happy couple. Capitalism and the Internet seemed a marriage made in heaven.

Internet Service Providers

A more sober analysis, however, can locate certain inconsistencies, if not contradictions, in ascribing so called “free markets” to the Internet, beyond the fact that the Internet’s very existence was a testament to public sector investment. Three areas stood out early on or have emerged forcefully in subsequent years.

First, the dominant wires that would come to deliver Internet service provider (ISP) broadband access for Americans were and are controlled by the handful of firms that dominated telephone and cable television. These firms were all local monopolies that existed because of government monopoly licenses. In effect, they have been the recipients of enormous indirect government subsidies through their government monopoly franchises. They would not know a “free market” if it kicked them in the corporate butt. Although often despised by consumers, they were arguably the most extraordinary lobbying force in the nation, as their survival depended on government authorization and support. The telephone companies had lent their wires to Internet transmission and, over the course of the 1990s, they—soon followed by the cable companies—realized it was their future, and a very lucrative one, at that. All the more so, considering that ISP’s are the only entry point to the Internet and digital networks.

These telephone and cable giants came to support the long process of what was called the “deregulation” of their industries that came to a head in the 1990s, not because they eagerly anticipated ferocious new competition, but because they suspected deregulation would allow them to grow ever larger and have more monopolistic power. It was a cynical moment. The stated justification for deregulation was that these traditional phone and cable monopolies would be permitted to use their wires to compete with each other in local markets, creating bona fide market competition. In exchange, restrictions on mergers would be relaxed, so they could gird themselves for the coming competitive warfare. Images of the Wild West Internet were invoked to suggest an onslaught of new competitors in telecommunication.

It was all nonsense, as the powerful incumbent players had sufficient monopoly power—both commercial and political—to assure no new serious competitors emerged. The upshot was that, although there has been almost no new competition as a result, there has been a wave of mergers shrinking the number of telephone and cable powerhouses down to between six and ten, depending on one’s criteria—around half the total from the mid-1990s—with AT&T, Verizon, and Comcast ruling the roost.

Deregulation has led to the worst of both worlds: fewer enormous firms with far less regulation.8 To top it off, the political power of these firms in Washington, D.C. and state capitals has reached Olympian heights. These monopolists are the poster children for crony capitalism, which in theory neoliberals despised but in practice they invariably championed.

This has had disastrous implications for broadband development in the United States. Unlike firms in many other nations, U.S. telephone and cable firms are not required to allow competitor broadband ISPs access to their wires, so there is virtually no meaningful competition in the now crucial broadband ISP industry. Fully 18 percent of U.S. households have access to no more than a single broadband provider—a monopoly. Using Federal Communications Commission (FCC) data (that the FCC acknowledges probably overstates the degree of actual competition), another 78 percent of U.S. households has at most two choices for wired broadband access, a duopoly comprised of the local monopoly telephone and cable companies. Economic theory suggests that, in a duopoly, the smart play for each firm is to imitate the other; and it is in both firms’ self-interest to have sky-high prices. The evidence suggests that in the coming years this situation is just as likely to get more monopolistic as it is to get more competitive. Meanwhile, four companies control the mushrooming U.S. wireless market, and the two leaders—AT&T and Verizon—are in the process of amassing one hundred million subscribers each. With dreams of converting the Internet into an expanded version of cable television, all of these firms have spectacular incentive to “privatize” the Internet as much as possible, and to use their control over broadband access as a bottleneck where they can exact additional tolls on users. Moreover, with little meaningful competition, as the FCC acknowledges, these firms have no particular incentive to upgrade their networks.9

Remarkably, the United States, which created and first developed the Internet, and which ranked, throughout the 1990s, close to first in world Internet connectivity, now ranks between fifteen and twenty in most global measures of broadband access, quality of service, and cost per megabit.10 There is no incentive to terminate the “digital divide,” whereby poor and rural Americans remain unconnected to broadband far beyond the rates in other advanced nations; a digital underclass encourages people to pay what it takes to avoid being unconnected. There is a striking comparison here to health care, where Americans pay far more than any other nation per capita, but get worse service, due to the parasitic existence of the health insurance industry. President Barack Obama said that if the United States were starting from scratch, it would obviously make more sense (from a public welfare standpoint) to have a publicly run health care system, and no private health insurance industry.11 The same overall logic applies to broadband Internet access, in spades.

It is worth noting that this is pretty much how Senator Al Gore understood matters during his years in Congress, when he championed funding for the Internet. In 1990 he argued that the natural foundation for the “information superhighway” would be a public network analogous to the interstate highway system.12 Lease the lines from the telecommunication companies, and then have them stay out of the way. That generally uncontroversial assessment was buried under an avalanche, once Wall Street cast its eyes that way, leading Vice President Al Gore to start singing a different tune, and has been long forgotten.

Market Concentration in Multiple Areas

There are many distinct levels at which Internet activity takes place, and all of them are in the process of being commercialized. The second area where conventional microeconomics would raise eyebrows if not ring alarm bells is how capitalist development of Internet-related industries has quickly, inexorably, generated considerable market concentration at almost every level, often beyond that found in non-digital markets. What this means is that there are multiple areas where private interests can get a chokehold on the Internet and seize monopoly profits, and they are all being pursued. Google, for example, holds 70 percent of the search engine market, and its share is increasing. It is on pace to challenge the market share that John D. Rockefeller’s Standard Oil had at its peak. Microsoft, Intel, Amazon, eBay, Facebook, Cisco, and a handful of other giants enjoy considerable monopolistic power as well. The crucial Wi-Fi chipset market, for example, is a duopoly where two firms have 80 percent of the market between them.13 Apple, via iTunes, controls an estimated 87 percent market share in digital music downloads and 70 percent of the MP3 player market.14

This, too, runs directly counter to the notion of the Internet as a generator of competition and consumer empowerment, and as a place for an alternative to the top-down corporate system to prosper. Writers like Clay Shirky and Yochai Benkler wax eloquent about the revolutionary potential for collaborative and cooperative work online. Some of this has carved out an important niche on the Internet, which stands as a tangible reminder of how different the Internet could look. They point to peer-to-peer activities, the Open Source movement, Mozilla Firefox, WikiLeaks, and the Wikipedia experience. We find this work illuminating and encouraging, and it points to the great potential of the Internet that we have only begun to tap.15

But this collaborative potential, arguably the democratic genius of the Internet, runs up against the pressure of capital to consolidate monopoly power, create artificial scarcity, and erect fences wherever possible. At nearly every turn, industries connected to the Internet have transitioned from competitive to oligopolistic in short order. To a large extent, this is a familiar story: any sane capitalist wants to have as much market power and as little competition as possible. By conventional economic theory, concentration in markets in general is bad for the efficient allocation of resources in an economy. Monopoly is the enemy of competition, and competition is what keeps the system honest.

It is supremely ironic that the Internet, the long-ballyhooed champion of increased consumer power and cutthroat competition, seems, in the end, to be more a force for monopoly. To be clear, the Internet is still crystallizing as an area of capitalist development, and historically speaking, appears quite dynamic, so it is premature to act as if the dust has settled. Nevertheless, the monopolistic tendencies in the overall economy are powerful, and the Internet adds a couple of additional wrinkles of its own to the mix.

In an area where technology is paramount, commercial interests have incentive to acquire proprietary rights to a technical standard that is highly desirable, or even necessary, for users of the system. Consider the H.264 codec, owned by the MPEG LA group, with licenses held by Microsoft, Apple, and others. It is quickly becoming the standard for online video, currently getting 66 percent of the market. With a bottleneck on Internet traffic like this, the owners of H.264 can create much desired “billable moments.” Economists often term shakedowns like this “economic rents” to refer to the (undeserved) income economic actors receive by virtue of their ownership of a scarce resource, independent of the cost of production/reproduction.16

Most important, the Internet adds to the mix what economists term “network effects,” meaning that just about everyone gains by sharing use of a particular service or resource. Information networks, in particular, generate “demand-side economies of scale,” related to the capture of customers as opposed to supply-side economies of scale (prevalent in traditional oligopolistic industry) related to cost advantages as scale goes up.17 The largest firm in an industry increases its attractiveness to consumers by an order of magnitude as its gets a greater market share—similar to how a hurricane picks up speed as it crosses the ocean on a hot summer day—and makes it almost impossible for competitors with declining shares to remain attractive or competitive. Wired editor Chris Anderson put the matter succinctly: “Monopolies are actually even more likely in highly networked markets like the online world. The dark side of network effects is that rich nodes get richer. Metcalfe’s law, which states that the value of a network increases in proportion to the square of connections, creates winner-take-all markets, where the gap between the number one and number two players is typically large and growing.”18

Google is a classic example of economies of scale and monopoly power; as it grows larger, its search engine becomes ever more superior to erstwhile competitors, not to mention it gains the capacity to build up traditional barriers-to-entry and scare away anyone trying to mess with it.19 Its network effects are so large that it has drowned out all other search engines, allowing it to prosper by selling data derived from its network to others (as well as prominently positioning paid-for “sponsored links”), marketing the vast mine of data at its disposal. In the old days, such “winner take all” markets were termed “natural monopolies.”20

Likewise, consider Microsoft, which has been able to exploit the dependence of a wide range of software applications on its underlying operating system in order to lock in its operating system seemingly permanently, allowing it to enjoy long-term monopoly-pricing power. Any competitor, seeking to introduce a new, rival operating system, is faced with an enormous “applications barrier to entry.”21 “Apps” have thus become key to the construction of barriers of entry and monopoly power, not only in relation to information technology in general, but also, more crucially today, in relation to the Internet.

Along these lines, new devices, such as the iPhone and the iPad, carry with them applications specific to a given device that are designed to lock customers in a whole commercial domain that mediates between them and the Internet—quite differently than the Web—and that generates “network effects” and rising sales for the producer. The more that a particular device becomes the interface for whole networks of applications, the more customers are drawn in, and the exponential demand-side economies of scale take over. This directly translates into enormous economic power, and the ability to determine much of the technological landscape. Once such economic power is fully consolidated and people become increasingly dependent on a new device, network prices can be leveraged up.

For Anderson, all this is simply the way of things: “A technology is invented, it spreads, a thousand flowers bloom, and then some one finds a way to own it, locking others out. It happens every time….Indeed, there has hardly ever been a fortune created without a monopoly of some sort, or at least an oligopoly. This is the natural path of [capitalist] industrialization: invention, propagation, adoption, control….Openness is a wonderful thing in the nonmonetary economy….But eventually our tolerance for the delirious chaos of infinite competition finds its limits.”22 Here we are offered a false choice between unlimited, uncontrolled private competition with its economic uncertainties or private monopoly and the formation of great fortunes. The exclusion of the public realm is taken as an article of faith.

Monopoly power that Anderson says is “even more likely” to emerge in the Internet’s highly networked markets begets all sorts of problems. Such monopolistic firms accrue huge amounts of cash with which they can gobble up any potential competitor or promising upstart attempting to create a new commercial sector on the Internet. These corporate giants use their monopoly base camps to make expeditions to conquer new areas in the Internet, especially those in proximity to their monopoly undertaking. Google, for example, has a purported $33 billion in cash to play with. It has spent many billions making several dozen key Internet acquisitions, averaging around one acquisition per month, over the past several years. In just the first three quarters of 2010, Google reported that it made forty distinct acquisitions.23 Microsoft, with $43 billion in cash on hand, has a similar record. Apple is sitting on $51 billion in cash to play with.

The idea that new technological breakthroughs will create competition online is increasingly absurd, and if it does somehow happen, it will only be a temporary stop on the way to more monopoly. The exceptional case is not actual competition—that is not even in the range of outcomes—but, instead when a new application avoids being conquered by an existing giant and creates another new monopolistic powerhouse (a new Facebook, for example) because the upstart is able to escape the clutches or enticements of an existing giant laden with cash, and create its own “walled garden” of economic value. The name of the game in such “walled gardens” of value is to exploit what economists now sometimes call “an enhanced surplus extraction effect,” that is, the increased ability to fleece those walled within.24

Even more dire by the standards of conventional economics is the manner in which this monopoly power permits giant Internet firms effectively to control the policy-making process and rigidify their power with minimal public “interference.” To the extent there are genuine policy debates, it is because powerful firms and sectors—much like King Kong and Godzilla—square off against one another. The most striking manner in which this political power manifests itself is with regard to electromagnetic spectrum, which can be defined as “the resource on which all forms of electronic wireless communication rely—the range of frequencies usable for the transmission of information.” There is an enormous amount of unused spectrum that could be put to use—greater than the amount actually in use—but the incumbent spectrum users prefer the artificial scarcity that rewards them, and the government obliges. In 2011 AT&T alone has license to $10 billion worth of spectrum that is laying fallow, while it lobbies to have more spectrum diverted to it.25

Some economists acknowledge that such monopolistic tendencies are emerging but claim they will only be temporary, due to the technological dynamism of the digital world. The usual assumption is that new technology will beat down the walls erected around any monopolistic market in a Schumpeterian wave of creative destruction. But there is little evidence to support this claim—at least in the relevant time frame of a human society—given these giant firms’ power to shape the entire terrain of the market, and their enormous size and financial and political power, which increase with leaps and bounds. There may be some reshuffling of the deck, but these giant monopolies are here for the duration

In much economic theory, natural monopolies should either be publicly owned or, at the very least, heavily regulated to prevent abuses, especially as they often tend to monopolize crucial public functions. The free market option does not compute. This most certainly applies to the telephone and cable companies which rule the broadband ISP roost. (André Schiffrin suggests this is the debate we should be having about Google.26) Yet corporate political power has basically eliminated the threat of public ownership, as well as the government aggressively enforcing its antitrust laws, which, if applied in the manner that was common a generation or two ago, would almost certainly have attempted to break up many of these firms. The regulation that has remained, antitrust or otherwise, has done as much, or more, to guarantee the existence of profitable firms and industries as it has to protect and preserve public interest values threatened by commercial interests.

In the realm of the Internet, a state-corporate alliance has developed that is matched perhaps only in finance and militarism. It makes a mockery of traditional economics, with its emphasis on an independent private sector responding to a competitive market. It also makes a mockery of the traditional liberal notion that capitalist democracy works because economic power and political power are in two distinct sets of hands, and that these interests have strong conflicts that protect the public from tyranny. Examples of how large communication corporations and the national security state work hand-in-hand are beginning to proliferate. The one that was exposed—and is singularly terrifying—concerned how, for much of the past decade, AT&T illegally and secretly monitored the communications of its customers on behalf of the National Security Agency.27 The more recent stories of how Amazon and PayPal/eBay cooperated with the government in the WikiLeaks affair may not be in the same league, but they point to the demise of the separation of public and private interests at the heart of liberal democratic theory.

Without meaning to be pejorative or alarmist, it is difficult to avoid noting that what is emerging veers toward the classic definition of fascism as right-wing corporatism: the state and large corporate interests working hand-in-hand to promote corporate interests, and a state preoccupied with militarism, secrecy, and surveillance.28 In such an environment, political liberty, except to the extent it is trivial or unthreatening, is on softer ground.

This integration of corporations and the state leads us to reappraise one of the greatest claims for the Internet: the notion that the Internet was impervious to control or censorship, and is the tool of the democratic activist. The same Internet, for both commercial and political reasons, can provide an unparalleled instrument for surveillance.29 This does not mean that activists cannot use the Internet to do extraordinary organizing, merely that this has to be balanced with the notion that the Internet can make individual privacy from state and corporate interests difficult, if not impossible. The monopoly-capitalist development of the Internet has given more weight to the antidemocratic tendency.

Information as a Public Good

If the Internet has proven a spawning ground for monopoly, it has additional problems when we look specifically at how capitalist media industries address the digital world. This is the third area of conflict between economic theory and the Internet, and probably the most deep-seated. Media products have always been a fundamental problem for capitalist economics, going back to the advent of the book. The problem is that a person’s use of information, unlike tangible goods and services, does not prohibit others from using it (in economic terms, it is non-rivalrous and non-exclusionary). For tangible products, the type that fills economics textbooks, one person consuming a product or service precludes another person from consuming the same product or service. Two people cannot eat the same hamburger or simultaneously drive the same automobile. More of the product or service needs to be produced to satisfy additional demand.

Not so with information. Karl Marx did not need to write individual copies of Capital for every single reader. Likewise, whether two hundred or two hundred million people read Capital would not detract from any one reader’s experience of it. What this meant for book publishing was that anyone who purchased a book could then print additional copies and sell them. There would be free market competition, and the price of the book would come tumbling down to the marginal cost of publishing a copy. But authors would only receive compensation for those copies of the book they personally published or authorized. Consumers got inexpensive books, which was great for a democratic culture, but authors did not necessarily receive enough compensation to make it worth their while to write books. The market did not work.

This was the origin of copyright laws, so important that their principle is inscribed in the U.S. Constitution. Authors received temporary monopoly rights to control who could publish their books to make certain the author received sufficient compensation. Thomas Jefferson only reluctantly agreed to copyright, detesting it as a government-created monopoly that was effectively a tax on knowledge. The Constitution states explicitly that copyright licenses cannot be permanent, and their initial length was fourteen years. (To be accurate, the driving force behind copyright was not authors as much as publishers, whose business prospects hinged on getting government monopoly privileges.)

When new media technologies developed and powerful media corporations emerged in the twentieth century, they were able to pressure Congress routinely to extend the length and scope of copyright protection—or, to put it in plain English, government monopoly protection licenses—dramatically. This has been a godsend to their bottom lines—indeed, to the very existence of their industries—but at a high cost to consumers and artists wishing to use material protected by copyright for licenses that can extend well over one hundred years. It is now routinely extended so we have, in effect, permanent copyright on the installment plan, and nothing produced since the 1920s has been added to the public domain. Copyright has long ago lost its loose connection to promoting the interests of the itinerant author, and has become a major policy to protect the wholesale privatization of our common culture.30

But that still did not eliminate the core economic problem, which new technologies only aggravated. Consider over-the-air broadcasting. Whether one person or one million people listened to a program did not affect the cost of producing the program. The marginal cost of the program for additional listeners was zero, and by conventional market economics, the justifiable price for the program should therefore be zero. Likewise, a broadcaster could not charge a listener to tune in to a program, because she could listen for free. Other nations solved this dilemma by creating state-funded public broadcasting systems that broadcast programs to which anyone who owned a radio (or television) could listen (or watch). The United States solved this problem by allowing business advertising to subsidize broadcasting conducted by for-profit corporations. The issue in the early 1930s of whether broadcasting should be a capitalist industry was one of the more important debates in U.S. media history.31 Later, cable and satellite television created artificial scarcity to force people to subscribe in order to watch channels like HBO or Showtime.

The Internet raised the market problem suggested by broadcasting exponentially. Now digital content could be spread instantly, at no charge, all over the world with the push of a button. “Scarcity,” which, as Adam Smith said in The Wealth of Nations, “is degraded by abundance,” and yet is a requirement for capitalist market economies, no longer existed.32 It seemed difficult to erect effective barriers. Once sufficient broadband existed, music, movies, books, TV shows—everything!—would be out there in cyberspace accessible to anyone for free. The immediate response of the commercial media to their worst nightmare was to ratchet up copyright enforcement, and this has proven to be somewhat effective, though at a high cost for Internet users, undermining the very ability to link and draw from other work that makes the Internet so revolutionary. Another major prong of this response was the development of digital rights management (DRM) technologies that imposed artificial limitations on the functionalities of digital devices and software.33

That still did not answer the question of where the money would come from if entertainment media were to transition to a digital world. Commercial media turned, again, to Madison Avenue, and advertising has begun to move online, though nowhere near the “old media” levels. At the same time, the largest media conglomerates were working furtively with the giant telecommunication and Internet firms to find ways to sell content effectively online. Apple’s iTunes began to point the way: downplay the open Internet, the World Wide Web, and set up proprietary systems.34

The Internet today is seeing a wave of alliances among the largest corporations at all levels of our analysis. Erecting large walls, creating scarcity, is the name of the game. The 2011 merger of Comcast with NBC (owner of Universal film studios as well as television interests) appears to be the first great merger of the new era. The future increasingly looks like one where the wireless Internet world will come to equal or exceed the traditional wireline broadband sector, and this will be a proprietary system that does not practice “network neutrality” or have the openness long associated with the Internet. We should expect more great mergers among and between the largest media, telecommunication, computer, and Internet corporations, along the lines of Comcast-NBC.

As the authors of a 2011 report by the New America Foundation put it, we are entering a world of digital feudalism, where a handful of colossal corporate mega-giants rule private empires. Advertising will be given every opportunity to exploit the system, and any meaningful notion of privacy will have to be sacrificed. “For once the fate of a network—its fairness, its rule set, its capacity for social or economic reformation—is in the hands of policymakers and the corporations funding them,” one of the earliest champions of the democratic Internet recently observed, “that network loses its power to effect change.”35 It is a world that would have been considered impossible not too long ago, but it is the destination at which one inevitably arrives, if capitalism is behind the steering wheel.

The Matter of Journalism

It appears that corporate entertainment media may have found a path to a digital future—albeit at a very high cost, and without the consideration of alternatives—but the same cannot be said for journalism, or, for that matter, freedom of speech. Here conventional economics provides useful assistance in developing a critique, but one is also informed by elementary liberal democratic theory and U.S. history. The U.S. system of governance as originally conceived—and as subsequently interpreted by the Supreme Court—is predicated on having a credible news media system to inform citizens of pressing matters and monitor those in, and those who wish to be in, power. The Internet arguably came with greater promise for journalism, freedom of speech, and democratic renewal than for any other area. Here, therefore, the failure is most profound.

In the initial euphoria, the Internet tended to lead people to think that it could smash the barriers-to-entry to the old media monopoly and arrive at a verdant new competitive era of media. As Grateful Dead lyricist and “cyberlibertarian” John Perry Barlow famously put it, back in 1995, the big media conglomerates, in making their mergers and acquisitions, were merely “rearranging deck chairs on the Titanic.” They would all soon be submerged by the Internet, with its unlimited number of Web sites.36 All sorts of newcomers could enter what had been a restricted field, and if they could locate a following, they would be able to generate sufficient revenues to make a go of it.

It did not happen quite this way, either for entertainment media or for journalism. Putting together an attractive Web site people would want to visit and support in large numbers requires resources. If the big guys, with all their advantages, were struggling to make a go of it, it was a nightmare for everyone else. In fact, no content-creating newcomers have been able to enter the field in any significant manner and make money, despite the ostensible opportunity to leapfrog existing barriers-to-entry. The huge media conglomerates are only now in the process of converting the digital realm into a lucrative source of profit making for entertainment products—and the profits still pale in comparison to those generated by their “old media” operations.

Journalism is a rather different matter. It is an area, unlike entertainment media, where copyright plays a minimal role in the business operation. Unlike books or music or films, the content tends to be produced for immediate consumption. Moreover, journalism has a somewhat different economic problem than commercial entertainment, one that precedes and is independent of the Internet: providing sufficient quality and quantity of reportage has always been a problem for the market. There is little evidence that final purchasers of news media throughout history ever comprised a large enough revenue base to support a satisfactory popular news media, something that democratic governance requires.

In the first century of the United States, the press system received support both from political parties and from enormous federal printing and postal subsidies. Were the U.S. federal government to subsidize journalism in 2011 at the same percentage of GDP it did in the 1840s, it would spend in the $30-35 billion range.37 (Contrast that to the approximate $400 million allocated to public broadcasting by the federal government in 2011.)

By the twentieth century, a commercial newspaper system was fully in place—and federal subsidies fell sharply, though they never disappeared—but now the majority of revenues came from commercial advertisers, who had little interest in journalism per se, and great interest in selling their products to newspaper readers.

Capitalist control over the news media has always been problematic: commercial values have tended to be incongruous with journalism as a public service; and owners have enjoyed using the political power of the press to their advantage. That prerogative was generally weighted toward advancing the interests of the owning classes. In fact, “professional journalism” emerged as a form of industry self-regulation in the first half of the twentieth century, to some extent to allay concerns about monopolistic or commercial control over public information. It did so by informally delegating control of the newsroom to professionally trained editors and reporters. The professional system was probably at its peak in the 1960s or 1970s, and even then it was far from perfect.38

The current crisis of journalism began in the 1970s, owing in part to increasing corporate consolidation of ownership, which exploded in the 1980s. In monopolistic markets, media owners had incentive to lowball the resources to newsrooms, assuming they would keep their customers and advertisers. These firms were out to maximize profit, and journalism was merely a means to that end.

The system of professional journalism began to wither. Corporate owners increasingly found journalism too expensive for their tastes. The number of working journalists per capita began to decline by the late 1980s, though corporate news media profits were booming, and in the first decade of the new century, the number of journalists fell off a cliff. In 1960 the ratio of public relations people—attempting surreptitiously to doctor the news—to working journalists was around 1-to-1. In 2011 the ratio approaches 4-to-1. Large sections of public life are barely covered anymore, and those that are rely to a much larger extent on the unfiltered missives of PR firms. Add to this the rabid right-wing partisan ramblings of commercial media, and we are, in many respects, in the midst of a golden age of propaganda.

The Internet did not cause the crisis of journalism, but it certainly accentuated it. It took away tens of billions of dollars of advertising—in one decade, Craigslist alone all but wiped out $20 billion in newspaper classified advertising. Advertisers had no particular commitment to newspapers any more than journalism, and the digital world created new and better alternatives. The Internet also provided one more reason for young people to avoid reading increasingly flaccid newspapers or watching TV news. The one thing news media had done that was unique—provide original coverage of events in their communities and on their beats—had been cut back. What they replaced it with—sports, entertainment news, trivia—could be found anywhere and had no connection to “hard” news.

Journalism has many traits of a public good. It is something society needs and something a self-governing society requires. But the market cannot produce journalism in sufficient quantity or quality. Public goods generally require public subsidy and explicit public policies to exist. This was implicitly understood during the first century of U.S. history, but the role of advertising in supporting journalism masked its public good characteristics thereafter. For the past century, media critics have concentrated on how the market has negatively affected the quality of journalism; now, as the dust clears, the issue of the quantity of the news, of the very existence of popular journalism under capitalist auspices, has moved to the fore.

For the past decade, the great question has been: Will the Internet provide the market basis for resources sufficient to spawn a viable independent mass journalism? The answer is now in: It won’t. Not even close. The corporate news media sector will provide its version of greatly scaled-back news online, but by no account will this come close to filling the breach, and that does not even broach the issue of the quality of this corporate journalism. If there are going to be independent, competing newsrooms covering the world in the coming years, it will require a major change from the current course. It will have to recognize the particular economics of journalism and the irrelevance, even mendacity, of the “free market” approach. In short, this is precisely a public policy debate of the first order.

The one saving grace of the Internet, its genius if you will, was that at the end of the day, no matter what, any person could start a Web site and acquire uncensored access to a global audience. This was democracy’s trump card against tyranny. Regrettably, we can now see that, as wonderful as it is to visit Web sites featuring material that would never see the light of day in mainstream media or the corporate Web sites, it is not sufficient. As Internet scholar Matthew Hindman has put it, we should not confuse the right to speak with the ability to be heard.

The evidence is now in: though there are an infinite number of Web sites, human beings are only capable of meaningfully visiting a small number of them on a regular basis. The Google search mechanism strongly encourages implicit censorship, in that sites that do not end up on the first or second page of a search effectively do not exist. As Michael Wolff puts it in Wired: “[T]he top 10 Web sites accounted for 31 percent of US pageviews in 2001, 40 percent in 2006, and about 75 percent in 2010.” “Big sucks the traffic out of small,” Wolff quotes Russian Internet investor Yuri Milner. “In theory you can have a few very successful individuals controlling hundreds of millions of people. You can become big fast.” And once you get big, you stay big.39

Hindman’s research on journalism, news media, and political Web sites is striking in this regard. What has emerged is “power law” distribution where a small number of political or news media Web sites get the vast majority of traffic.40 They are dominated by the traditional giants with name recognition and resources. There is a “long tail” of gazillions of Web sites that exist but get little or no traffic, and few people have any idea that they exist. Most of them wither, as their producers have little incentive and resources to maintain them. (This is not to denigrate the “long tail,” as its existence is of considerable value and political importance; the point, instead, is to emphasize that the “long tail” is precluded from having the resources to enter the heart of the system and gain widespread exposure.) There is also no “middle class” of robust, moderately sized Web sites; that aspect of the news media system has been wiped out online. It leads Hindman to conclude that the online news media are more concentrated than the old media world. This is true, too, of the vaunted blogosphere, which has effectively ossified. Its traffic is highly concentrated in a handful of sites, operated by people with astonishingly elite pedigrees. Although the right to launch a Web site and speak to the world persists, its real-world significance is diminishing, as the proprietary realms of the wireless Internet render the open Web less relevant.

In sum, the Internet, left prey to capitalism—to having the hunt for profits dictate its development—has veered off in a direction that downplays and undermines, rather than exploits and accentuates, the most revolutionary and democratic aspects of its technology. As long as the Internet is assumed to be primarily a profit-generating medium, and all policy and regulation is premised on that presupposition, it is difficult to imagine a different course than the one described herein. For some, like Wired’s Chris Anderson, this is the way of the market and therefore the way of the world. But, as we have shown, the capitalist development of the Internet creates significant problems by the standards of market economics. Evidence abounds that another course is necessary. Fortunately, another way of envisioning the Internet is available, again from the field of economics itself.

The Lauderdale Paradox41

In order to explain at a deeper level the fate of the Internet, arising from its unholy marriage with capitalism, it is necessary to introduce a distinction that is nonexistent in today’s neoclassical economics, but that was central to economics in its classical beginnings: one between public wealth and private riches.

The contradictions of the prevailing conception of wealth are best explained in terms of what is known in the history of economics as the “Lauderdale Paradox.” James Maitland, the eighth Earl of Lauderdale (1759-1839), was the author of An Inquiry into the Nature and Origin of Public Wealth and into the Means and Causes of its Increase (1804). In the paradox with which his name came to be associated, Lauderdale argued that there was an inverse correlation between public wealth and private riches such that an increase in the latter often served to diminish the former. “Public wealth,” he wrote, “may be accurately defined,—to consist of all that man desires, as useful or delightful to him.” Such goods have use value and thus constitute wealth. But private riches, as opposed to wealth, require something additional (i.e., have an added limitation), consisting “of all that man desires as useful or delightful to him; which exists in a degree of scarcity.”

Scarcity, in other words, is a necessary requirement for something to have value in exchange, and to augment private riches. But this is not the case for public wealth, which encompasses all value in use, and thus includes not only what is scarce but also what is abundant. This paradox led Lauderdale to argue that increases in scarcity in such formerly abundant but necessary elements of life as air, water, and food would, if exchange values were then attached to them, enhance individual private riches, and indeed the riches of the country—conceived of as “the sum-total of individual riches”—but only at the expense of the common wealth. For example, if one could monopolize water that had previously been freely available by placing a fee on wells, the measured riches of the nation would be increased at the expense of the growing thirst of the population.

“The common sense of mankind,” Lauderdale contended, “would revolt” at any proposal to augment private riches “by creating a scarcity of any commodity generally useful and necessary to man.” Nevertheless, he was aware that the capitalist society in which he lived was already, in many ways, doing something of the very sort. He explained that in particularly fertile periods, Dutch colonialists burned “spiceries” or paid natives “for collecting the young blossoms or green leaves of the nutmeg trees” to kill them off; and that in plentiful years “the tobacco-planters in Virginia,” by legal enactment, burned “a certain proportion of tobacco” for every slave working their fields. Such practices were designed to increase scarcity, augmenting private riches (and the wealth of a few) by destroying or artificially limiting what constituted public wealth—in this case, the produce of the earth. “So truly is this principle understood by those whose interest leads them to take advantage of it,” Lauderdale wrote, “that nothing but the impossibility of general combination protects the public wealth against the rapacity of private avarice.”42

Lauderdale explicitly extended his paradox to the world of art and culture. “The High price of a painting or any other work of Art,” he wrote, “may make the fortune of the Artist,” and contribute to the private riches of whoever is fortunate enough to possess the work of art, but this can be seen as contributing at the same time to “the poverty of the community in the article of that species of painting,” which is valued based on its scarcity and inaccessibility.43 To be sure, scarcity in the realm of artistic production was partly the product of a “monopoly arising from skill, talent, and genius,” and to that extent constituted a justifiable tax on the public.44 Yet the community clearly did not gain in those cases where art was artificially restricted and monopolized so as to enhance its exchange value, putting it out of the reach of the majority of the population. A flowering of the arts in the culture, including a profusion of artistic talent, would ideally lead to prices falling, to the point that works of art could be diffused more generally and more easily shared, thereby enhancing public wealth. Basing his analysis on Adam Smith’s observations in The Wealth of Nations, Lauderdale was aware that the great estates of the wealthy demonstrated, as Smith had put it, “conveniences and ornaments of building, dress, equipage, and household furniture,” as well as artistic reproductions, that were monopolized for the exclusive enjoyment of the rich, and the desire for which on their part was “altogether endless.”45 For Lauderdale, such monopolization of art added to private opulence in direct proportion to the loss it represented to public wealth.

From the beginning, wealth, as opposed to mere riches, was associated in classical political economy with what John Locke called “intrinsic value,” and what later political economists were to call “use value.”46 Use values had, of course, always existed, and were the basis of human existence. But commodities produced for sale on the market under capitalism also embodied something else: exchange value (value). Every commodity was thus viewed as having “a twofold aspect,” consisting of use value and exchange value.47 The Lauderdale Paradox was an expression of this twofold aspect of wealth/value, which generated the contradiction between total public wealth (the sum of use values) and the aggregation of private riches (the sum of exchange values).

David Ricardo, the greatest of the classical-liberal political economists, responded to Lauderdale’s paradox by underscoring the importance of keeping wealth and value (use value and exchange value) conceptually distinct. In line with Lauderdale, Ricardo stressed that if water, or some other natural resource formerly freely available, acquired an exchange value due to the growth of scarcity, there would be “an actual loss of wealth” reflecting the loss of use values—even with an increase of private riches.48

In contrast, Adam Smith’s leading French follower, Jean Baptiste Say, who was to be one of the precursors of neoclassical economics, responded to the Lauderdale Paradox by simply defining it away. He argued that wealth (use value) should be subsumed under value (exchange value), effectively obliterating the former. In his Letters to Malthus on Political Economy and Stagnation of Commerce (1821), Say thus objected outright to “the definition of which Lord Lauderdale gives of wealth.” It was absolutely essential, in Say’s view, to abandon altogether the identification of wealth with use value. Say did not deny that there were “things indeed which are natural wealth, very precious to man, but which are not of that kind about which political economy can be employed.” But political economy was to encompass in its concept of value—which was to displace altogether the concept of wealth as such—nothing but exchangeable value.49

Nowhere in classical liberal political economy were the contradictions posed by the Lauderdale Paradox more apparent, generating more convolutions in logic, than in John Stuart Mill’s Principles of Political Economy. In the “Preliminary Remarks” to his book, Mill declared (after Say) that, “wealth, then, may be defined, [as] all useful or agreeable things which posses exchangeable value”—thereby essentially reducing wealth to exchange value. But Mill’s characteristic eclecticism and his classical roots led him also to expose the larger irrationality of this, undermining his own argument. Thus, we find in the same section a penetrating treatment of the Lauderdale Paradox, pointing to the conflict between capital accumulation and the wealth of the commons/public wealth. According to Mill:

Things for which nothing could be obtained in exchange, however useful or necessary they may be, are not wealth in the sense in which the term is used in Political Economy. Air, for example, though the most absolute of necessaries, bears no price in the market, because it can be obtained gratuitously: to accumulate a stock of it would yield no profit or advantage to any one; and the laws of its production and distribution are the subject of a very different study from Political Economy. But though air is not wealth, mankind are much richer by obtaining it gratis, since the time and labour which would otherwise be required for supplying the most pressing of all wants, can be devoted to other purposes. It is possible to imagine circumstances in which air would be a part of wealth. If it became customary to sojourn long in places where the air does not naturally penetrate, as in diving-bells sunk in the sea, a supply of air artificially furnished would, like water conveyed into houses, bear a price: and if from any revolution in nature the atmosphere became too scanty for the consumption, or could be monopolized, air might acquire a very high marketable value. In such a case, the possession of it, beyond his own wants, would be, to its owner, wealth; and the general wealth of mankind might at first sight appear to be increased, by what would be so great a calamity to them. The error would lie in not considering, that however rich the possessor of air might become at the expense of the rest of the community, all persons else would be poorer by all that they were compelled to pay for what they had before obtained without payment.50

Mill signaled here, in line with Lauderdale, the possibility of a vast rift in capitalist economies between the narrow pursuit of private riches on an increasingly monopolistic basis, and the public wealth of society and the commons. Yet, despite these deep insights, he closed off the discussion with these “Preliminary Remarks,” rejecting the Lauderdale Paradox in the end, by defining wealth simply as exchangeable value.

In contrast, Marx, like Ricardo, not only held fast to the Lauderdale Paradox but also made it his own, insisting that the contradictions between use value and exchange value, wealth and value, were intrinsic to capitalist production. In The Poverty of Philosophy, he responded to Proudhon’s confused treatment (in The Philosophy of Poverty) of the opposition between use value and exchange value by pointing out that this contradiction had been explained most dramatically by Lauderdale, who had “founded his system on the inverse ratio of the two kinds of value.” Indeed, Marx built his entire critique of political economy in large part around the contradiction between use value and exchange value, indicating that this was one of the key components of his argument in Capital.51

In analyzing the political economic conditions in the United States, Marx drew critically on Edward Gibbon Wakefield’s argument on the political economy of colonization. Wakefield claimed that the main problem facing capitalism in the new colonial lands, such as the United States, Canada, and Australia, was the very abundance of public land, which was an obstacle to the development of wage labor. With free, abundant land available, workers quickly fled the conditions of exploited labor and the commodity sphere altogether, becoming subsistence farmers and small proprietors. The priority in such conditions, Wakefield insisted, was to find ways to make land scarce, through the artificial inflation of land prices and the promotion of absentee ownership, thereby effectively closing off what had been public land to the majority of the population. “In the interest of the so-called wealth of the nation,” Marx observed, Wakefield sought the “artificial means to ensure the poverty of the people.”52

As with Lauderdale, only with greater force and consistency, Marx contended that capitalism was a system predicated on the accumulation of exchange value, even at the expense of real wealth/use values, including the social character (and welfare) of human labor itself. “Après moi le deluge! is the watchword of every capitalist and of every capitalist nation.”53 In a similar vein, Thorstein Veblen, in the 1920s, was to describe “the American plan” of resource exploitation, as “a settled practice of converting all public wealth to private gain on a plan of legalized seizure,” destroying much of the real wealth of society in the process.54

The whole classical conception of wealth in this respect was to be turned upside down with the rise of neoclassical economics. This can be seen in the work of Carl Menger, one of the founders of neoclassical economics. In his Principles of Economics (1871) Menger attacked the Lauderdale Paradox directly, arguing that it was “exceedingly impressive at first glance,” but was based on false distinctions. For Menger, it was important to reject both the use value/exchange value and wealth/value distinctions. Wealth was based on exchange, which was now seen as rooted in subjective utilities. Standing Lauderdale on his head, he suggested that it would make sense from a purely economic standpoint to encourage “a long continued diminution of abundantly available (non-economic) goods [(e.g., air, water, natural landscapes) since this] must finally make them scarce in some degree—and thus components of wealth, which is thereby increased.” In the same vein, Menger claimed that mineral water could be conceived as an economic good, due to its scarcity, i.e., as long as it did not flow in abundance and could thus be distinguished quantitatively as well as qualitatively from freshwater in general. What Lauderdale (and Ricardo and Marx) presented as a paradox or even a curse—the promotion of private riches through the artificial generation of scarcity—Menger, one of the precursors of neoliberalism in economics, saw as a means of expanding wealth, and thus a desirable end in itself.55

As a result, the dominant neoclassical tradition moved steadily away from any concept of social/public wealth, excluding the whole question of social (and natural) costs from its core analysis.56 An oil spill in the Gulf of Mexico increases GDP by promoting cleanup and litigation costs, while registering little in the way of economic losses. “The Lauderdale Paradox,” as ecological economist Herman Daly has remarked, “seems to be the price we pay for measuring wealth in terms of exchange value” rather than in terms of use value.57

The Paradox of the Internet

What we have referred to as the “paradox of the Internet” in a capitalist society is to be viewed as a corollary to the Lauderdale Paradox.58 In a world in which private riches grow at the expense of public wealth, it should not surprise us that what seemed at first as the enormous potential of the Internet—representing a whole new realm of public wealth, analogous to the discovery of a whole new continent, and pointing to the possibility of a vast new democratic sphere of unrestricted communication—has vaporized in a couple of decades. Competitive strategy in this sphere revolves around the concept of the lock-in of customers and the leveraging of demand-side economies of scale, which allow for the creation of massive concentrations of capital in individual firms.

Like the elimination of free land in the United States, the Internet is being transformed into a few dominant spaces that are thereby able to exploit their scarcity value. The effective “closure” (or displacement) of much of the free public space on the Internet, which now seems to be occurring, means that what was once clearly a form of public wealth in new communicative possibilities, as measured by use values—that is, in the new, universal human capacities it seemed to promise—is giving way to a very different type of system. Here exchange value dominates, and the disappearance of those use values associated with relatively free communication comes to be registered as a gain in wealth, since it produces massive private riches overnight.

From a capitalist standpoint, it is the very abundance represented by the Internet that has thwarted profit-making. “There is no Commodity,” Lauderdale wrote, “that would not loose [sic] the attribute of value if it existed in as great abundance as Air or Water. Abundance therefore will not only necessarily degrade the value of any Commodity, but a sufficient abundance will inevitably destroy it.”59

Since scarcity in the case of the Internet has to be created, and hence is artificial—indeed “artificial scarcity is the natural goal of the profit-seeking,” writes Wired’s Anderson60—it requires the full panoply of what Joseph Schumpeter called “monopolistic practices” (or “the editing of competition”) to bring it about. The result is the domination of the firms that are at best “co-respecters” (as opposed to full competitors), with considerable monopoly/oligopoly power, thus able to obtain surplus profits or monopolistic rents.61 An innovation is commercially developed, and a market created, only by finding a way to “wall” off a sector of public wealth and effectively privatize and monopolize it, leading to huge returns. Information, which is a public good—by nature available to all and, if consumed by one person, still available to others—is, in this way, turned into a scarce private commodity through the exercise of sheer market power.

All of this is possible, however, only with the cooperation of the public sector. The privatization and monopolization of the Internet requires a state, which, in partnership with capital, neither provides the population with the alternatives necessary to develop access to this public domain, nor protects it against Internet robber barons. The state, in effect, looks the other way when it sees new realms of economic wealth being made out of “nothing” (the value attributed to, say, the electromagnetic spectrum outside market exchange) and fails to move against rapid concentration of capital, even facilitating the latter.

The FCC’s approval of the 2011 merger of Comcast and NBC Universal is a case in point. As FCC Commissioner Michael Copps stated, in his lone dissenting vote: the merger “opens the door to cable-ization of the Internet.” According to Copps, this creates “the potential for walled gardens, toll booths, content prioritization, access fees to reach end users, and a stake in the heart of independent content production.”62 Public wealth, free access, net neutrality, and a democratic communicative sphere are all losers. In this way, the real wealth of the Internet, like a newly discovered land that has not yet been explored, is given away to private interests—before the population has been able to realize or even to imagine the full material use value of such a realm, if managed in the public interest.

Communication is more than an ordinary market. Indeed, it is properly not a market at all. It is more like air or water—a form of public wealth, a commons. When Aristotle said that human beings were “social animals,” he might just as well have said that we are communicative animals. We know that the human brain coevolved with language (a social characteristic).63 The development of social relations and democratic forms, as well as science, culture, etc., are all communicative. The rise of the Internet as a form of free communication, seemingly without limits, thus raises the prospect of vast new realms of human sociability and enhanced democratic possibilities. Yet, rather than a means of expanding human sociability, the Internet is being turned into the opposite: a new means of alienation. There is nothing natural in this process; at bottom it remains a social choice.

The moral of the story is clear. People in the United States and worldwide must redouble their efforts to address the paradox of the Internet at all levels of the analysis presented herein. The outcome is far from certain, and the issues are still very much in play. A global network of resistance is both necessary and feasible. Indeed, in view of the nature of the Internet and the stakes involved, it seems fair to say that these issues will only become more encompassing in coming years. How this battle plays out will go a long way toward determining our future as social animals.

Acknowledgments

We received criticism and assistance on this piece from Vivek Chibber, Brett Clark, Matt Crain, Susan Crawford, Hannah Holleman, R. Jamil Jonna, James Losey, Fred Magdoff, Sascha Meinrath, Victor Pickard, Dan Schiller, Ben Scott, Derek Turner, Matt Wood, and Tim Wu. We cannot thank them enough.

Notes

- ↩ For a discussion of this point, see Robert W. McChesney, Communication Revolution (New York: The New Press, 2007), ch. 3.

- ↩ For important recent discussions of the negative implications of the digital revolution, see Nicholas Carr, The Shallows: What the Internet Is Doing to Our Brains (New York: W.W. Norton, 2010); Sherry Turkle, Alone Together: Why We Expect More from Technology and Less from Each Other (New York: Basic Books, 2011).

- ↩ Wilhelm Ostwald, “Breaking the Boundaries,” The Masses (February 1911), 15-16.

- ↩ Email from Sascha Meinrath to Robert W. McChesney, January 6, 2011.

- ↩ Kenneth David Nichols, The Road to Trinity: A Personal Account of How America’s Nuclear Policies Were Made (New York: William Morrow and Company, 1987), 34-35.

- ↩ See Ha-Joon Chang, 23 Things They Don’t Tell You About Capitalism (New York: Bloomsbury Press, 2010) for a superb discussion of this point and debunking of the other ideological ballast underpinning neoliberal economics.

- ↩ Bill Gates, The Road Ahead (New York: Viking, 1995), 180.

- ↩ For a revealing discussion of the 1990s lobbying by the telephone companies, see Tim Wu, The Master Switch: The Rise and Fall of Information Empires (New York: Alfred A. Knopf, 2010).

- ↩ The information in this paragraph comes from Connecting America: The National Broadcasting Plan (Washington, D.C.: Federal Communications Commission, 2010), 37-38.

- ↩ For OECD data see OECD, Directorate for Science, Technology and Industry, OECD Broadband Portal, http://oecd.org. See also: James Losey and Chiehyu Li, Price of the Pipe: Comparing the Price of Broadband Service Around the Globe (Washington, DC: New America Foundation, 2010).

- ↩ Lynn Sweet, “Obama on why he is not for single payer health insurance. New Mexico town hall transcript,” Chicago Sun Times, May 14, 2009, http://blogs.suntimes.com. Of course, Obama’s statement was partly meant to justify acceding to the demands of the insurance companies, since a truly rational course, he implied, was no longer possible. He was wrong. It would still make more sense today from a health care standpoint to move to a publicly run health care system, but vested interests, which benefit from the present system, stand in the way.

- ↩ Al Gore, “Networking the Future: We Need a National ‘Superhighway’ for Computer Information,” Washington Post, July 15, 1990, B3.

- ↩ Sascha D. Meinrath, James W. Losey, and Victor W. Pickard, “Digital Feudalism: Enclosures and Erasures from Digital Rights Management to the Digital Divide,” CommLaw Conspectus, vol. 19, no. 2 (2011).

- ↩ Adam L. Penenberg, “The Evolution of Amazon,” Fast Company (July 2009), 66-74.

- ↩ Yochai Benkler, The Wealth of Networks (New Haven: Yale University Press, 2006); Clay Shirky, Cognitive Surplus: Creativity and Generosity in a Connected Age (New York: The Penguin Press, 2010).

- ↩ Meinrath, Losey and Pickard.

- ↩ Carl Shapiro and Hal R. Varian, Information Rules (Boston: Harvard Business School Press, 1999), 173.

- ↩ Chris Anderson, “The Web Is Dead; Long Live the Internet: Who’s to Blame: Us,” Wired 18 (September 2010): 122-27, 164.

- ↩ Matthew Hindman, The Myth of Digital Democracy (Princeton: Princeton University Press, 2009), 84-86. Hindman does a superb job of demonstrating the immense capital expenses Google incurs to assure its dominance, and that all but guarantee no other firm can or will challenge it in the search engine market.

- ↩ Jia Lynn Yang, “Google: A ‘Natural Monopoly’?” Fortune, May 10, 2009, http://money.cnn.com.

- ↩ Hal R. Varian, Joseph Farrell, and Carl Shapiro, The Economics of Information Technology (Cambridge: Cambridge University Press, 2004), 37, 49, 71-72; Richard Gilbert and Michael L. Katz, “An Economists’s Guide to US v. Microsoft,” Journal of Economic Perspectives 15, no. 2 (2001): 30.

- ↩ Anderson, “The Web Is Dead,” 126.

- ↩ Google, Inc., “Quarterly Report Form 10-Q,” September 30, 2010. http://investor.google.com/documents/20100930_google_10Q.html.

- ↩ Anderson, “The Web Is Dead,” 127; Varian, Farrell, and Shapiro, The Economics of Information Technology, 14.

- ↩ Karl Bode, “AT&T Wants FCC To Free More Spectrum—For Them To Squat On,” Broadband DSL Reports, January 14, 2011, http://dslreports.com.

- ↩ André Schiffrin, Words and Money (London: Verso, 2011).

- ↩ See Wu, 249-52.

- ↩ See Bertram Gross, Friendly Fascism: The New Face of Power in America (Boston: South End Press, 1980) for a prescient take on the matter.

- ↩ Evgeny Morozov, The Net Delusion: The Dark Side of Internet Freedom (New York: Public Affairs, 2011).

- ↩ See Lawrence Lessig, Free Culture (New York: Penguin, 2004) and Kembrew McLeod, Freedom of Expression (New York: Doubleday, 2005).

- ↩ See Robert W. McChesney, Telecommunications, Mass Media and Democracy: The Battle for the Control of U.S. Broadcasting, 1928-1935 (New York Oxford University Press, 1993).

- ↩ Adam Smith, The Wealth of Nations (New York: Modern Library, 1937), 173.

- ↩ See Tarleton Gillespie, Wired Shut: Copyright and the Shape of Digital Culture (Cambridge: MIT Press, 2007).

- ↩ Apple’s “app store” for the iPhone and iPad is a great example of this model in which the distribution for software (with very limited functionality) is highly controlled and locked to specific devices. Jonathan Zittrain calls this “tethering,” although he is more concerned with security and is by no means critical of capitalism. See Jonathan Zittrain, The Future of the Internet and How to Stop It (New Haven: Yale University Press, 2008).

- ↩ Douglas Rushkoff, “The Next Net,” January 3, 2011, http:/shareable.net.

- ↩ Steven Levy, “How the Propeller Heads Stole the Electronic Future,” New York Times (September 24, 1995), 58.